CFA Foundation Training

Get CFA Foundation ready with a globally trusted curriculum, adaptive AI learning, and expert-led instruction.

EduEdge Pro’s CFA Foundation Program blends expert-led training with AI-driven self-learning via BloombergPrep. Whether you prefer structured classroom sessions or flexible online learning, there's a plan for you.

40 hours of in-class Training

10 hours of Q&A, Doubt-solving

Training by CFA charter-holders

Adaptive Learning through AI

Personalized Study Pathways & Plans

Powered by BloombergPrep

Hundreds of students have already walked the CFA path with us, and succeeded.

It is with great enthusiasm that we introduce our CFA Foundation Course, designed to build a strong groundwork in core finance concepts for aspiring professionals. This program serves as the ideal stepping stone towards the CFA journey, helping participants gain clarity on fundamental topics such as ethics, quantitative methods, economics, and financial reporting. By combining expert-led instruction with structured learning resources, the course ensures a solid conceptual base and enhanced confidence before progressing to the CFA Level 1 examination.

Founder & CEO | EduEdge Pro

Stanford University Alumnus |

CFA, FRM, CAIA, PRM, CMT |

Visiting Faculty - IIM

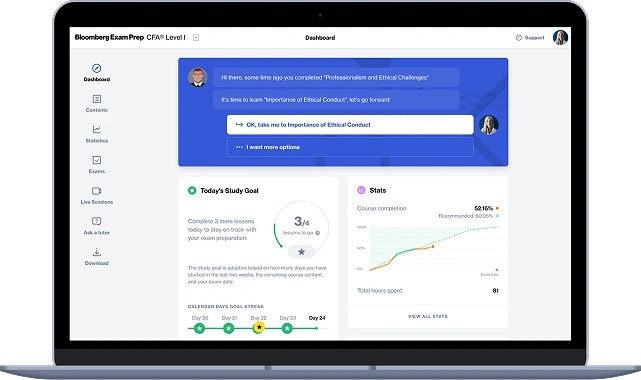

Get full access to the BloombergPrep CFA learning app.

AI-driven adaptive learning for personalized study plans.

Utilizes AI to tailor study plans based on your performance, focusing on areas that need improvement.

Access to micro lessons and 1000+ exam-style practice questions.

Expert-led discussions on key concepts tested in the CFA exam. Sessions by CFA Charterholders.

Application of theories in the industry with hands-on examples and Excel models and templates.

Timed assessments with detailed reviews.

Dedicated Q&A segments to clarify concepts

Goldman Sachs

J.P. Morgan

Morgan Stanley

Barclays

BlackRock

Fidelity Investments

T. Rowe Price

Invesco

Citibank

Bank of America

Standard Chartered

ICICI Bank

McKinsey & Company

Bain & Company

Deloitte

PwC

Blackstone

Carlyle Group

Sequoia Capital

Accel

Charles Schwab

Raymond James

Motilal Oswal

IIFL Wealth

Bloomberg

Refinitiv

Morningstar

Zerodha

RBI

SEBI

CRISIL

MSCI

INR60,000 + GST

INR40,000 + GST