CFA Level 1 Training Program 2025

Get CFA Level 1-ready with a globally trusted curriculum, adaptive AI learning, and expert-led instruction.

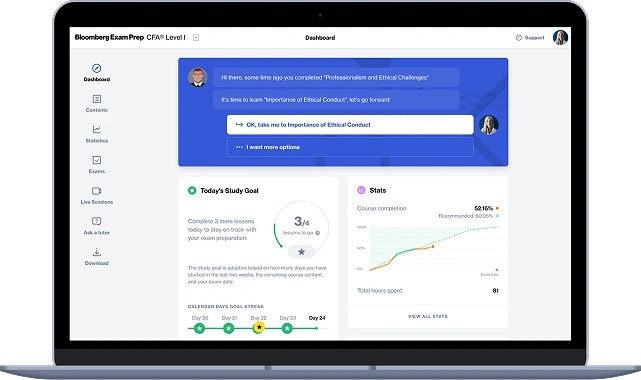

EduEdge Pro’s CFA Level 1 Program blends expert-led training with AI-driven self-learning via BloombergPrep. Whether you prefer structured classroom sessions or flexible online learning, there's a plan for you.

60+ Hours of Live Classroom or Online Training

200+ Hours of AI-Based Self-Paced Learning

BloombergPrep Learning App Access

1000+ Practice Questions & 7 Full-Length Mock Exams

Doubt-Solving & Revision Support by CFA Experts

Financial Modelling with Excel Templates Included

Hundreds of students have already walked the CFA path with us, and succeeded.

It is with great enthusiasm that we introduce our CFA Level 1 Training Program, designed to equip aspiring finance professionals with the knowledge and skills necessary to excel in the CFA examination. In partnership with BloombergPrep CFA Essentials, this program leverages cutting-edge adaptive learning technology to ensure an efficient and personalized study experience.

Founder & CEO | EduEdge Pro

Stanford University Alumnus |

CFA, FRM, CAIA, PRM, CMT |

Visiting Faculty - IIM

Get full access to BloombergPrep CFA learning app.

AI-driven adaptive learning for personalized study plans.

Utilizes AI to tailor study plans based on your performance, focusing on areas that need improvement.

Access to micro lessons and 1000+ exam-style practice questions.

Expert-led discussions on key concepts tested in the CFA exam. Sessions by CFA Charterholders.

Application of theories in the industry with hands-on examples and Excel models and templates.

Timed assessments with detailed reviews.

Dedicated Q&A segments to clarify concepts

Goldman Sachs

J.P. Morgan

Morgan Stanley

Barclays

BlackRock

Fidelity Investments

T. Rowe Price

Invesco

Citibank

Bank of America

Standard Chartered

ICICI Bank

McKinsey & Company

Bain & Company

Deloitte

PwC

Blackstone

Carlyle Group

Sequoia Capital

Accel

Charles Schwab

Raymond James

Motilal Oswal

IIFL Wealth

Bloomberg

Refinitiv

Morningstar

Zerodha

RBI

SEBI

CRISIL

MSCI

INR25,000 + GST

INR55,000 + GST

INR105,000 + GST

The CFA Level 1 exam is the first of three exams offered by the CFA Institute to earn the Chartered Financial Analyst® (CFA®) designation. It focuses on foundational knowledge in investment tools, asset valuation, and portfolio management.

To register, candidates must:

The exam is computer-based, consisting of 180 multiple-choice questions - divided into two sessions of 2 hours 15 minutes each, with 90 questions per session.

There are 10 topic areas, including:

It is offered four times a year — in February, May, August, and November.

CFA Institute does not disclose a fixed passing score. Historically, it has ranged between 65% to 75%, depending on overall performance distributions.

Enrollment Fee (one-time): USD 350 (as of 2025)

Exam Registration Fee:

(Fee structure may vary based on deadlines)

Once you pass Level 1, your results don’t expire. You can take Level 2 and Level 3 at your own pace.

Yes, but rescheduling comes with a fee and must be done within the deadline window. No refunds are given after registration, except in limited cases (medical emergencies, etc.).