CFA Level 2 Training Program 2025

Expert-led, AI-supported training to elevate performance and boost your CFA exam readiness.

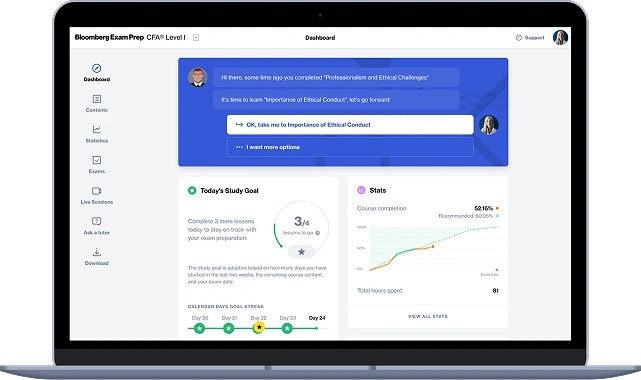

This 60-hour CFA Level 2 program combines expert-led instruction, AI-driven practice via BloombergPrep, and practical tools like financial modeling to drive efficiency and exam success.

60+ hours of live training led by CFA Charterholders

200+ hours of adaptive self-paced learning with BloombergPrep

Financial modeling sessions with Excel-based industry application

Mock exams, test analytics, and performance review

Doubt-clearing and revision sessions for every learner

Personalized study plans using AI-based learning algorithms

This CFA Level 2 program is designed for those committed to advancing in finance, including:

Our students have consistently achieved a 93% success rate, proving our expert-led training approach.

It is with great enthusiasm that we introduce our CFA Level 2 Training Program—designed specifically for finance professionals looking to deepen their analytical capabilities and progress confidently toward becoming CFA charterholders. Developed in collaboration with BloombergPrep CFA Essentials, this program combines adaptive learning technology with exam-focused content to deliver a rigorous, personalized, and efficient preparation experience.

Founder & CEO | EduEdge Pro

Stanford University Alumnus |

CFA, FRM, CAIA, PRM, CMT |

Visiting Faculty - IIM

Get full access to the BloombergPrep CFA Learning App for seamless on-the-go study.

Benefit from AI-driven study plans tailored to your strengths and weaknesses.

AI tracks your performance to focus on concepts that need more attention, optimizing your prep time.

Short, focused lessons and 1000+ exam-style questions to reinforce learning and improve accuracy.

Learn directly from CFA Charterholders with in-depth discussions on high-weightage CFA Level 2 concepts.

Apply CFA theories to real-world scenarios using Excel-based financial models, templates, and hands-on case studies.

Attempt timed mock exams followed by detailed performance reviews to pinpoint strengths and areas for improvement.

Get all your queries answered in dedicated Q&A forums to strengthen conceptual clarity and test readiness.

Goldman Sachs

J.P. Morgan

Morgan Stanley

Barclays

BlackRock

Fidelity Investments

T. Rowe Price

Invesco

Citibank

Bank of America

Standard Chartered

ICICI Bank

McKinsey & Company

Bain & Company

Deloitte

PwC

Blackstone

Carlyle Group

Sequoia Capital

Accel

Charles Schwab

Raymond James

Motilal Oswal

IIFL Wealth

Bloomberg

Refinitiv

Morningstar

Zerodha

RBI

SEBI

CRISIL

MSCI

INR35,000 + GST

INR65,000 + GST

INR145,000 + GST

The CFA Level 2 exam is the second of three exams required to earn the CFA® charter. It emphasizes the application of investment tools and concepts in real-world scenarios, focusing heavily on asset valuation and industry-specific analysis.

The exam is computer-based and consists of 88 multiple-choice questions split across item sets. It’s divided into two sessions of 2 hours and 12 minutes each, with 44 questions per session.

While Level 1 tests foundational concepts, Level 2 assesses your ability to apply those concepts in case-based scenarios. Emphasis is placed on interpreting data, conducting valuations, and integrating ethics into complex decision-making.

Level 2 also includes 10 topic areas, weighted as follows (approximate):

The CFA Level 2 exam is offered twice a year — typically in May and August/November, depending on CFA Institute’s global schedule.

The CFA Institute uses a modified Angoff method to determine the minimum passing score (MPS), which varies by year. Your performance is compared to this benchmark; however, exact scores and the MPS are not disclosed.

You must have passed the CFA Level 1 exam and meet the CFA Program’s professional conduct requirements. There are no additional educational or work experience prerequisites for Level 2.

Most candidates spend an average of 325–375 hours preparing for Level 2. Due to the item-set format, more time is needed for concept application, mock testing, and analysis.

Our program offers 60+ hours of expert-led instruction, 200+ hours of AI-driven adaptive learning via BloombergPrep, mock exams, Excel-based financial modeling, and 1:1 doubt-clearing to boost your exam performance.

Yes, but changes must be made within the CFA Institute’s deadlines. A rescheduling fee applies. Refunds are typically not allowed unless for approved exceptions such as medical emergencies.